GPU mining vastly outperforms CPU mining with respect to profitability. GPUs are specifically designed for parallel processing, resulting in higher hash rates and better efficiency in solving complex mining algorithms. This efficiency translates to greater Bitcoin or cryptocurrency yields. Meanwhile, CPU mining is limited by lower processing power, leading to reduced returns. Factors such as mining difficulty and power consumption further differentiate the two. More insights into the nuances of these mining strategies can enhance understanding of their economic implications.

Key Takeaways

- GPU mining delivers superior hash rates and efficiency, making it more profitable than CPU mining for demanding cryptocurrencies like Ethereum.

- Power consumption is a significant cost; GPUs generally have better hash-to-watt ratios, enhancing profitability.

- Initial investment in GPUs is higher, but long-term operational efficiency often outweighs the upfront costs compared to CPUs.

- Mining difficulty and market conditions greatly affect profitability; GPUs are better suited for adapting to these fluctuations.

- Maintenance and resale values for GPUs can impact overall profitability, requiring careful consideration for long-term mining plans.

Overview of GPU Mining and CPU Mining

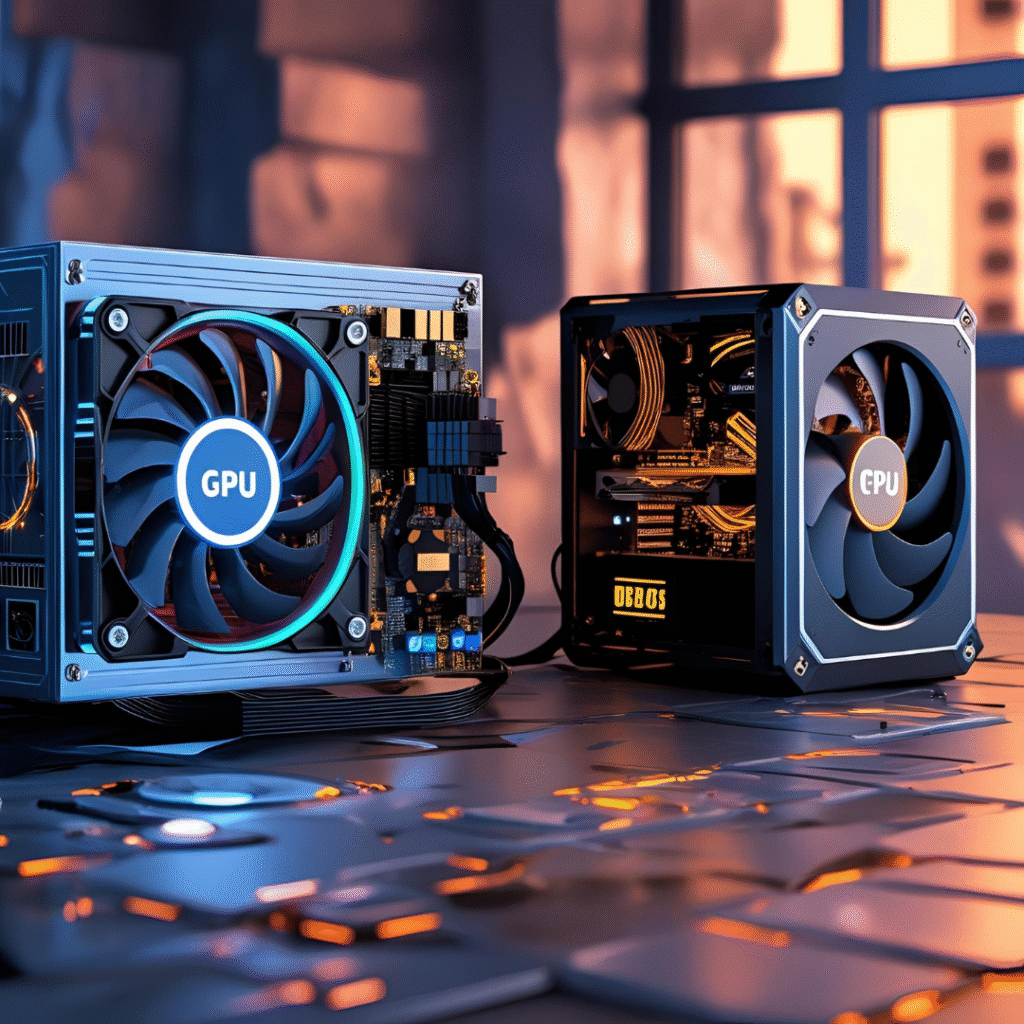

In the domain of cryptocurrency mining, two primary methods dominate the landscape: GPU mining and CPU mining.

GPU mining utilizes specialized mining hardware equipped with graphics processing units, designed to handle complex mining algorithms efficiently. This method excels in processing multiple transactions simultaneously, making it ideal for cryptocurrencies like Ethereum.

Conversely, CPU mining employs standard central processing units, which are less powerful in comparison. While CPU mining is accessible and does not require significant investment in hardware, it struggles with the increasing difficulty of mining algorithms.

The efficiency and speed of GPU mining typically lead to higher profitability, appealing to those seeking to maximize their returns.

Understanding these differences is vital for miners evaluating GPU mining vs CPU mining profitability.

Key Factors Influencing Mining Profitability

Several key factors greatly influence the **profitability** of mining operations, determining whether GPU mining or CPU mining yields better returns. Understanding these factors is vital for miners seeking peak performance.

- Mining Difficulty: Higher difficulty levels can drastically reduce potential rewards, impacting overall profitability.

- Power Consumption: The energy cost associated with mining equipment is a significant expense that can erode profits.

- Hardware Efficiency: The performance of the mining hardware directly correlates with the amount of cryptocurrency mined.

- Market Conditions: Fluctuations in cryptocurrency prices can affect profitability, making timing essential.

Comparative Analysis of GPU Mining Vs CPU Mining Profitability

Mining profitability is heavily influenced by various factors, and a comparative analysis of GPU mining versus CPU mining profitability reveals significant distinctions in performance and returns.

GPUs typically excel in parallel processing, allowing them to efficiently handle complex mining algorithms, resulting in higher hash rates compared to CPUs. This enhanced performance translates to greater profitability, particularly in mining cryptocurrencies with demanding algorithms.

Additionally, energy consumption is a critical factor; GPUs often provide a better hash-to-watt ratio, making them more energy-efficient for sustained operations.

In contrast, CPU mining generally yields lower returns due to its reduced processing power and higher energy costs per hash.

Consequently, for those seeking maximum profitability in mining endeavors, GPUs clearly outperform CPUs in most scenarios.

Cost Considerations in Mining Equipment

While the overarching goal in mining is to maximize profitability, the Initial investment in equipment plays an essential role in determining overall success. The choice between GPU and CPU mining hinges not only on profitability but also on cost considerations related to mining hardware and energy efficiency.

Key factors influencing these costs include:

- Initial Equipment Cost: GPUs typically require a higher upfront investment than CPUs.

- Operational Costs: Energy consumption varies greatly, affecting long-term profitability.

- Maintenance: GPUs generally necessitate more regular **maintenance** due to higher heat output.

- Resale Value: Market demand can influence the potential **resale value** of mining hardware.

Understanding these elements is critical for miners aiming to optimize their profitability in the GPU mining vs CPU mining profitability landscape.

Future Trends in Mining Profitability

As the landscape of cryptocurrency evolves, the future trends in mining profitability are increasingly shaped by advancements in technology and shifts in the market.

Future technologies, such as ASIC miners and cloud mining solutions, are likely to redefine the competitive edge, optimizing energy consumption and enhancing hash rates.

Additionally, the volatility of market fluctuations will heavily influence profitability, as miners must adapt to changing coin values and transaction fees.

Economic models suggest that as more miners enter the space, profitability may decline unless innovations in efficiency emerge.

Consequently, staying informed on technological developments and market trends will be essential for miners seeking to maximize returns in the ongoing GPU mining vs CPU mining profitability debate.

Frequently Asked Questions

What Cryptocurrencies Are Best Suited for GPU Mining?

When considering ideal cryptocurrencies for GPU mining, Ethereum Classic and Ravencoin emerge as top choices. Their algorithms favor parallel processing, allowing GPUs to maximize efficiency and return on investment, appealing to serious miners seeking profitability.

Can CPU Mining Still Be Profitable Today?

The analysis of CPU mining viability reveals diminishing returns compared to historical CPU profits. Current market conditions suggest limited profitability, as evolving technology favors GPU alternatives, making CPU mining less appealing for serious investors in today’s landscape.

How Do Electricity Costs Affect Mining Profitability?

Electricity costs greatly influence mining profitability, as higher electricity rates reduce cost efficiency. Miners must carefully analyze their energy expenses to determine the viability of their operations, ultimately impacting overall returns and sustainability.

What Are the Cooling Requirements for GPU Mining Rigs?

Cooling requirements for GPU mining rigs are critical; effective GPU cooling enhances performance and longevity. Mining rig maintenance should prioritize adequate airflow and temperature regulation to prevent overheating, thereby optimizing efficiency and ensuring sustained operational integrity.

Is Mining Software Different for GPU and CPU Setups?

Mining software varies considerably for GPU and CPU setups, primarily due to hardware compatibility. Each type requires tailored configurations to optimize performance, reflecting the inherent differences in processing capabilities and power consumption between the two.

Conclusion

In the analysis of GPU versus CPU mining profitability, it is evident that GPU mining generally offers superior efficiency and higher returns due to its advanced computational capabilities. Factors such as electricity costs, hardware investment, and cryptocurrency volatility greatly influence overall profitability. While CPU mining remains accessible for beginners, its lower efficiency often results in diminished returns. As technology evolves and market dynamics shift, miners must continuously evaluate these factors to optimize their investment strategies in the cryptocurrency landscape.