Bitcoin vs. Ripple serve different roles within the cryptocurrency ecosystem. Bitcoin functions primarily as a decentralized store of value, gaining traction as digital gold, while Ripple specializes in facilitating efficient cross-border transactions for financial institutions. Market performance reflects these distinctions, with Bitcoin showcasing higher volatility and broader acceptance compared to Ripple’s stability and niche focus. Regulatory scrutiny also differs, as Bitcoin emphasizes decentralization, whereas Ripple seeks cooperation with traditional finance. Understanding these factors reveals deeper insights into their respective futures.

Key Takeaways

- Bitcoin serves as a decentralized digital gold, prioritizing security and autonomy, while Ripple focuses on efficient cross-border payments for financial institutions.

- Bitcoin’s average transaction time is around 10 minutes, whereas Ripple processes transactions in 3-5 seconds, making it more suitable for instant payments.

- Bitcoin has a larger market cap exceeding $500 billion, compared to Ripple’s $25 billion, indicating broader acceptance and investment appeal.

- Bitcoin’s decentralized approach enhances security but complicates regulatory compliance, while Ripple’s partnerships with banks aim for regulatory approval despite centralization concerns.

- The future potential of Bitcoin as digital gold contrasts with Ripple’s goal to redefine cross-border transactions, catering to different user bases.

Overview of Bitcoin and Ripple

In the domain of cryptocurrencies, Bitcoin and Ripple stand as two of the most prominent entities, each representing distinct philosophies and functionalities within the digital currency landscape. Bitcoin, introduced in 2009, is often viewed as a decentralized digital gold, emphasizing security and autonomy through its blockchain technology. Its primary function is to serve as a store of value and medium of exchange, appealing to those seeking financial independence. In contrast, Ripple, launched in 2012, focuses on facilitating cross-border payments for financial institutions, leveraging its unique consensus algorithm to enable faster and cheaper transactions. This positioning aligns Ripple with traditional banking systems, fostering a more collaborative approach to finance. Together, Bitcoin and Ripple illustrate the diverse possibilities within the evolving cryptocurrency ecosystem.

Key Differences Between Bitcoin and Ripple

While both Bitcoin and Ripple operate within the cryptocurrency sphere, their foundational principles and operational mechanisms diverge considerably. Bitcoin is primarily a decentralized digital currency designed for user autonomy and security, while Ripple focuses on facilitating real-time cross-border transactions for financial institutions.

Key differences include:

- Consensus Mechanism: Bitcoin uses a proof-of-work system, requiring extensive computational efforts, whereas Ripple employs a consensus protocol that allows for faster transaction validation.

- Transaction Speed: Bitcoin transactions can take up to 10 minutes to confirm, while Ripple transactions are settled in seconds.

- Target Audience: Bitcoin aims at individual users seeking financial freedom, while Ripple targets banks and financial entities aiming to streamline their operations.

These distinctions underscore the contrasting roles Bitcoin and Ripple play in the evolving cryptocurrency landscape.

Use Cases: Bitcoin Vs Ripple in the Real World

In evaluating the use cases of Bitcoin vs Ripple in the real world, several key factors emerge, including transaction speed, financial institution adoption, and applications for everyday users. Bitcoin is often regarded as a store of value, while Ripple’s technology aims to facilitate quick and cost-effective cross-border transactions. This distinction highlights how each cryptocurrency is positioned within the financial ecosystem and its potential impact on various market segments.

Transaction Speed Comparison

Transaction speed serves as a critical differentiator between Bitcoin and Ripple, particularly when evaluating their real-world applications. Bitcoin transactions can take approximately 10 minutes to confirm, which can hinder its usability for everyday transactions. In contrast, Ripple’s transaction speed is notably faster, allowing for near-instantaneous settlements.

Key comparisons include:

- Confirmation Time: Bitcoin averages 10 minutes, while Ripple typically completes transactions in 3-5 seconds.

- Scalability: Bitcoin processes around 7 transactions per second, whereas Ripple can handle over 1,500.

- Cost Efficiency: Ripple’s low transaction fees contrast sharply with Bitcoin’s variable fees during high network demand.

These differences illustrate how Bitcoin vs Ripple caters to distinct needs in the evolving financial landscape.

Financial Institution Adoption

The differences in transaction speed between Bitcoin and Ripple have significant implications for their adoption by financial institutions. Bitcoin, while widely recognized as a store of value, often faces delays due to its slower processing times, making it less appealing for institutions seeking efficiency. In contrast, Ripple offers rapid transaction speeds, enabling financial institutions to settle cross-border payments almost instantly. This efficiency aligns with the demands of modern banking systems, which prioritize speed and cost-effectiveness. Consequently, Ripple has garnered interest from numerous banks and financial entities, seeking to enhance their payment infrastructures. Ultimately, while Bitcoin serves a different purpose as a digital asset, Ripple’s capabilities position it as a more viable option for institutions aiming to innovate their financial services, positioning Bitcoin vs Ripple in a distinct competitive landscape.

Everyday User Applications

While both Bitcoin and Ripple serve distinct functions within the cryptocurrency ecosystem, their everyday user applications highlight key differences in usability and practicality. Bitcoin often appeals to users seeking a store of value or investment, whereas Ripple is tailored for seamless transactions between financial institutions.

Key use cases include:

- Peer-to-Peer Transactions: Bitcoin allows individuals to send money across borders without intermediaries, whereas Ripple’s focus on banks facilitates faster, cost-effective transfers.

- Microtransactions: Bitcoin’s higher fees hinder small transactions, while Ripple’s low-cost model supports microtransactions efficiently.

- Remittances: Ripple excels in providing rapid cross-border remittances, making it a preferred choice for users needing quick and affordable international money transfers.

In the debate of Bitcoin Vs Ripple, these applications underscore their unique advantages in real-world scenarios.

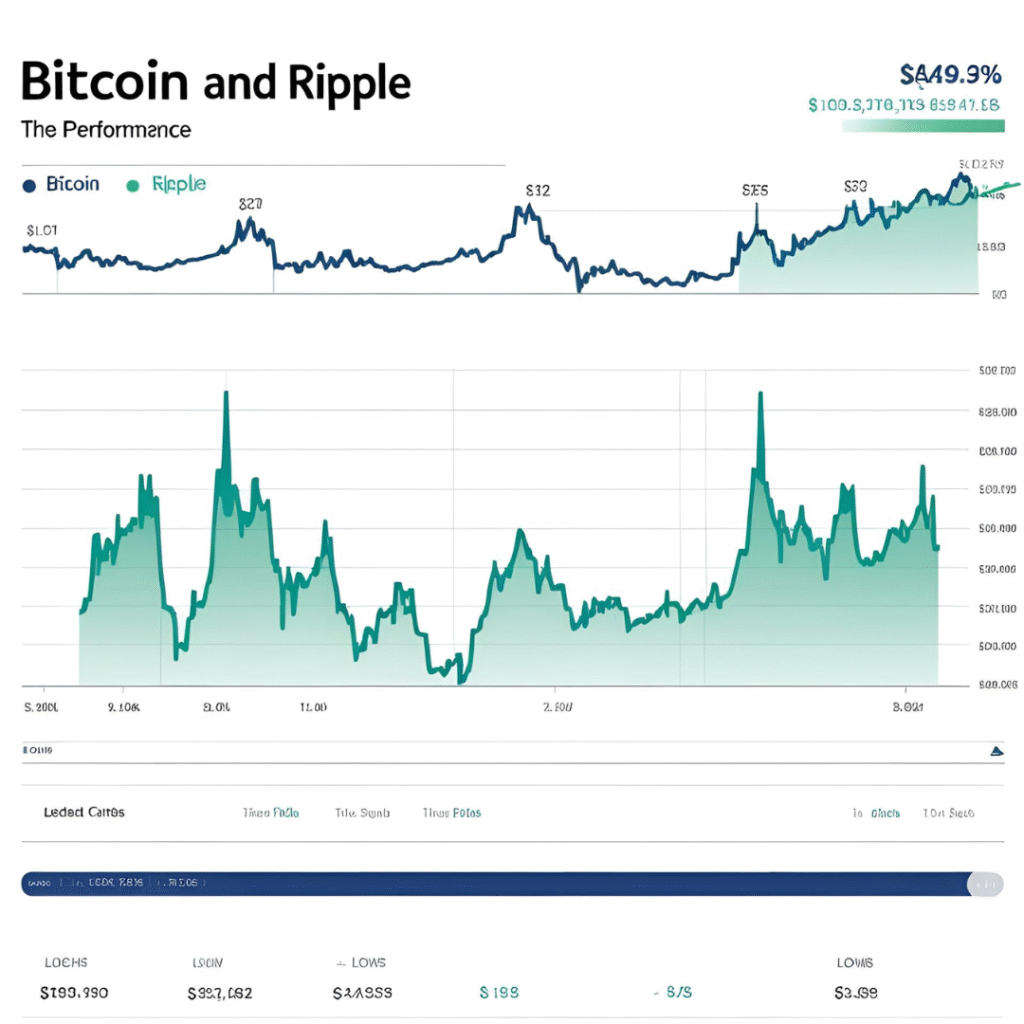

Market Performance: Analyzing Bitcoin and Ripple Trends

In the analysis of market performance, a comparison between Bitcoin and Ripple reveals significant differences in price volatility and market capitalization. Bitcoin often exhibits higher price swings, reflecting its status as a speculative asset, while Ripple tends to maintain a more stable valuation due to its utility in cross-border payments. Understanding these trends is essential for investors seeking to navigate the dynamics of Bitcoin vs. Ripple in the cryptocurrency landscape.

Price Volatility Comparison

Price volatility plays a critical role in evaluating the market performance of cryptocurrencies, particularly when comparing Bitcoin and Ripple. The differing degrees of price fluctuations between these two assets can influence investor sentiment and trading strategies.

- Bitcoin: Characterized by significant price swings, often exceeding 10% within a single day.

- Ripple: Generally exhibits lower volatility, with price changes typically ranging from 2-5% daily.

- Market Reaction: Bitcoin’s sharp price movements can lead to heightened excitement or panic, while Ripple’s stability may attract risk-averse investors.

Understanding these patterns is essential for those traversing the complex domain of digital currencies. Ultimately, the choice between Bitcoin and Ripple hinges on an investor’s tolerance for risk and their market objectives, shaping their journey into the cryptocurrency sector.

Market Capitalization Insights

Market capitalization serves as a vital indicator of the overall health and performance of cryptocurrencies, providing insights into the relative strength of Bitcoin and Ripple within the digital asset landscape. As of October 2023, Bitcoin continues to dominate with a market cap exceeding $500 billion, positioning it as the leading cryptocurrency. In contrast, Ripple, with a market cap around $25 billion, reflects its niche focus on facilitating cross-border transactions. This stark difference highlights Bitcoin’s broader acceptance and adoption among investors. However, Ripple’s targeted utility offers significant potential for growth, especially in financial institutions. As the market evolves, both Bitcoin and Ripple exhibit unique trends that cater to diverse investor interests, fostering a dynamic environment within the cryptocurrency ecosystem.

Security and Regulation: Bitcoin and Ripple Perspectives

Frequently regarded as a cornerstone of the cryptocurrency landscape, security and regulation are pivotal factors in the ongoing debate between Bitcoin and Ripple. Each cryptocurrency adopts distinct approaches to these issues, influencing their respective audiences and market perceptions.

- Bitcoin: Emphasizes decentralization, which enhances security but complicates regulatory compliance.

- Ripple: Focuses on partnerships with financial institutions, aiming for regulatory approval, yet raises concerns about centralization.

- Regulatory Scrutiny: Both face scrutiny, but Bitcoin’s established status contrasts with Ripple’s ongoing legal challenges, shaping their futures.

In the Bitcoin vs Ripple discourse, understanding these perspectives on security and regulation can help investors navigate the intricate landscape of cryptocurrencies, fostering a sense of belonging in this evolving community.

Community and Development: The Ecosystems Behind Bitcoin and Ripple

The ecosystems surrounding Bitcoin and Ripple demonstrate distinct community dynamics and development strategies, which greatly influence their adoption and longevity. Bitcoin thrives on a decentralized community approach, with developers and users advocating for its principles of security and independence. The Bitcoin community often emphasizes grassroots engagement, fostering a sense of belonging among enthusiasts committed to the original vision of peer-to-peer currency.

In contrast, Ripple’s ecosystem is characterized by partnerships with established financial institutions, focusing on enhancing existing systems rather than replacing them. This corporate-oriented strategy attracts a different user base, emphasizing innovation and efficiency. Both ecosystems reflect varying philosophies: one rooted in decentralization and the other in collaboration, ultimately shaping the trajectory of Bitcoin Vs. Ripple in the cryptocurrency landscape.

Future Potential: Bitcoin Vs. Ripple in the Coming Years

Shifts in community engagement and development strategies will greatly influence the future potential of Bitcoin and Ripple. As both cryptocurrencies evolve, their trajectories may diverge based on key factors:

- Adoption Rates: Bitcoin’s brand recognition versus Ripple’s partnerships with financial institutions could dictate user acceptance.

- Technological Advancements: Innovations in scalability and transaction speed will be essential for maintaining relevance in a competitive landscape.

- Regulatory Environment: How each platform navigates regulatory challenges will impact their sustainability and credibility.

In the coming years, Bitcoin Vs. Ripple will likely showcase distinct pathways. Bitcoin may continue to solidify its position as digital gold, while Ripple could redefine cross-border transactions, appealing to a network of traditional finance users seeking efficiency and reliability.

Frequently Asked Questions

What Are the Transaction Fees for Bitcoin and Ripple?

Transaction fees vary considerably between Bitcoin and Ripple. Bitcoin fees can fluctuate based on network congestion, often ranging from $1 to $10. In contrast, Ripple fees remain consistently low, typically around $0.00001 per transaction.

How Do Bitcoin and Ripple Handle Scalability Issues?

Scalability issues are addressed differently by Bitcoin and Ripple. Bitcoin employs techniques like the Lightning Network, while Ripple utilizes a consensus algorithm to enhance transaction speed and efficiency, enabling higher throughput in its network.

Can Bitcoin and Ripple Coexist in the Market?

The coexistence of Bitcoin and Ripple in the market appears feasible, as both serve distinct purposes. Bitcoin functions as a digital currency, while Ripple facilitates cross-border transactions, allowing them to thrive simultaneously within the evolving cryptocurrency ecosystem.

What Is the Environmental Impact of Bitcoin and Ripple?

The environmental impact of Bitcoin and Ripple varies considerably; Bitcoin’s energy-intensive mining process raises sustainability concerns, while Ripple’s consensus mechanism is more energy-efficient, highlighting differing approaches to environmental responsibility within the cryptocurrency landscape.

How Do Investors Typically Evaluate Bitcoin Versus Ripple?

Investors typically evaluate Bitcoin versus Ripple by analyzing market capitalization, transaction speed, scalability, and use cases. They also consider community support, regulatory factors, and historical performance, aiming to align their investment strategies with potential growth opportunities.

Conclusion

In the ongoing debate between Bitcoin and Ripple, both cryptocurrencies exhibit distinct advantages and serve different purposes within the financial ecosystem. Bitcoin’s status as a digital gold emphasizes its role as a store of value, while Ripple’s technology focuses on enhancing cross-border payment efficiency. As the market continues to evolve, the choice between the two ultimately depends on individual investor priorities—whether they seek long-term value appreciation or innovative transaction solutions. Understanding these dynamics is essential for informed investment decisions.