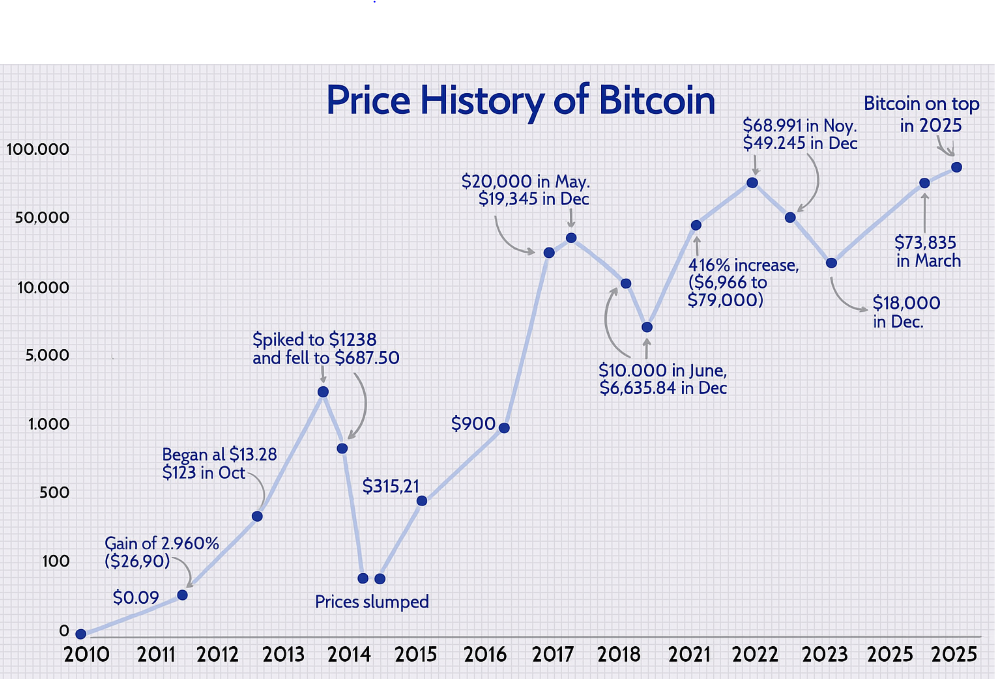

Bitcoin price history showcases a volatile yet significant evolution since its inception in 2009. Initially valued at nearly $0, it spiked to $1 in 2011 and reached peaks of nearly $20,000 in December 2017 and approximately $64,000 in April 2021. Regulatory changes, economic crises, and major events have profoundly influenced its valuation. Understanding these factors is essential for investors. Insights into Bitcoin’s intricate price dynamics can offer deeper perspectives on future trends.

Key Takeaways

- Bitcoin was launched in January 2009, starting with a price of nearly $0 and witnessing significant early growth.

- Major milestones include reaching $1 in 2011 and surging to nearly $20,000 in December 2017.

- Economic crises often lead to increased Bitcoin demand, as traditional assets falter, influencing its price volatility.

- Regulatory changes, such as China’s 2017 ban, have historically caused significant price drops and market reactivity.

- Future price stability may depend on institutional adoption and continued technological innovations within the Bitcoin ecosystem.

The Birth of Bitcoin: A Brief Overview

Although the exact origins of Bitcoin remain somewhat shrouded in mystery, its inception can be traced back to a whitepaper published in October 2008 by an individual or group under the pseudonym Satoshi Nakamoto. This document outlined a decentralized digital currency designed to facilitate peer-to-peer transactions without the need for intermediaries. The launch of the Bitcoin network followed in January 2009, marked by the mining of its first block, known as the “genesis block.” This event laid the groundwork for a new financial paradigm, emphasizing transparency, security, and autonomy. As Bitcoin began to attract early adopters, its innovative blockchain technology initiated discussions about the potential for digital currencies to reshape traditional economic systems, fostering a sense of community among enthusiasts and investors alike.

Early Price Fluctuations and Market Reactions

As Bitcoin emerged from its inception, its price experienced significant volatility, reflecting a market grappling with the implications of this novel digital asset. Early price fluctuations were influenced by various factors, including speculation and regulatory responses. Key market reactions included:

- Initial Trading: Bitcoin’s price began at virtually $0, quickly rising to $0.08 within months.

- First Major Spike: In 2011, Bitcoin reached $1, drawing attention from investors and media alike.

- Regulatory Scrutiny: Regulatory announcements often triggered sharp price drops, highlighting market sensitivity.

- Growing Adoption: Increased adoption by merchants and users began to stabilize prices, despite ongoing volatility.

These early price movements laid a complex foundation for Bitcoin’s price history, as participants navigated a rapidly evolving landscape.

Major Milestones in Bitcoin’s Price History

Major milestones in Bitcoin’s price history highlight significant events that have shaped its market trajectory. The early adoption surge marked the initial recognition of Bitcoin’s potential, while subsequent all-time highs signaled growing investor interest and market speculation. Recent market trends reflect ongoing volatility and evolving investor sentiment, underscoring Bitcoin’s dynamic nature in the financial landscape.

Early Adoption Surge

In the early years of Bitcoin’s existence, several key milestones markedly influenced its price trajectory, marking a transformative period in cryptocurrency adoption. These events not only shaped Bitcoin’s value but also fostered a growing community of enthusiasts. The following milestones stand out:

- 2009: Bitcoin’s launch with its genesis block, establishing the foundation for its value.

- 2010: The first recorded purchase using Bitcoin, where 10,000 BTC bought two pizzas, highlighting its practical use.

- 2011: Reaching parity with the US dollar, validating its potential as a currency.

- 2013: Surging past $1,000 for the first time, igniting widespread media attention and interest.

These developments in Bitcoin’s value history were essential in propelling its status within the financial landscape.

All-Time Highs

Although Bitcoin has experienced several fluctuations throughout its existence, the all-time highs represent critical milestones in Bitcoin’s price history that have shaped investor sentiment and market dynamics. Key peaks include December 2017, when Bitcoin reached nearly $20,000, and the significant surge to approximately $64,000 in April 2021. These milestones were driven by factors such as increased institutional interest, mainstream adoption, and macroeconomic conditions. Each peak not only attracted new investors but also fueled discussions around Bitcoin’s value proposition as a digital asset. The psychological impact of these all-time highs often leads to heightened market activity, influencing trading strategies and fostering a sense of community among investors, who seek to understand and capitalize on Bitcoin’s value history.

Recent Market Trends

As Bitcoin continues to navigate the complexities of the financial landscape, recent market trends have revealed significant milestones in Bitcoin’s price history that merit closer examination. Notable developments include:

- Institutional Adoption: Increased investments from major companies and financial institutions, signaling growing acceptance.

- Regulatory Scrutiny: Heightened government interest that impacts market sentiment and price volatility.

- Technological Advancements: Improvements in blockchain technology enhancing transaction efficiency and security, fostering user trust.

- Market Cycles: Periodic price surges followed by corrections, illustrating investor behavior and market psychology.

These trends not only shape Bitcoin’s trajectory but also reflect broader economic factors, reinforcing the cryptocurrency’s role in modern finance. Understanding these milestones is essential for anyone engaging with Bitcoin’s price history.

The Impact of Regulatory Changes on Bitcoin’s Value

Regulatory changes have consistently influenced Bitcoin’s price history, often leading to significant market reactions. Government policies, such as bans or endorsements of cryptocurrency trading, directly impact investor sentiment and market dynamics. As a result, understanding these regulatory shifts is essential for analyzing Bitcoin’s value fluctuations.

Government Policies Influence Prices

Government policies play an essential role in shaping Bitcoin’s price history, as changes in regulations can greatly influence market sentiment and investor behavior. Various regulatory actions have historically led to fluctuations in Bitcoin’s value, often reflecting the broader economic landscape. Key influences include:

- Tax Regulations: Taxation policies can either encourage or hinder investment in Bitcoin.

- Legal Status: Recognizing Bitcoin as legal tender can boost its legitimacy and value.

- Security Regulations: Stricter regulations on exchanges may deter participation and impact liquidity.

- International Relations: Geopolitical tensions can affect Bitcoin’s attractiveness as a safe haven asset.

Market Reactions to Regulations

Changes in regulations often elicit immediate and pronounced reactions from the Bitcoin market, reflecting the asset’s sensitivity to external policy shifts. Historical data indicates that announcements of regulatory measures, such as bans or endorsements, frequently lead to sharp price fluctuations. For instance, when China implemented crackdowns on cryptocurrency trading in 2021, Bitcoin’s value plummeted by nearly 30% within days. Conversely, positive regulatory news, such as the approval of Bitcoin ETFs in the United States, has historically driven prices upward. These reactions underscore the interconnectedness between regulatory frameworks and Bitcoin’s price history, showcasing how investor sentiment is heavily influenced by governmental actions. Consequently, understanding these dynamics is essential for those engaged in or contemplating Bitcoin investments.

Bitcoin’s Price During Economic Crises

As economic crises unfold, Bitcoin’s price often exhibits distinctive patterns that reflect both investor sentiment and market dynamics. During periods of financial turmoil, several key trends can be observed:

- Volatility Spike: Prices may experience significant fluctuations, driven by panic selling or speculative buying.

- Increased Interest: As traditional assets falter, Bitcoin often garners attention as a perceived safe haven.

- Correlation with Gold: Investors may draw parallels between Bitcoin and gold, leading to price movements influenced by gold’s performance.

- Market Sentiment: Fear and uncertainty can create a surge in demand, pushing prices higher despite overall market declines.

Understanding Bitcoin’s price history during economic crises provides insights into its evolving role and the psychology of investors in turbulent times.

Key Events That Influenced Bitcoin’s Price Trends

Economic crises are not the only factors that shape Bitcoin’s price; several significant events have also played pivotal roles in its valuation. Major milestones include the introduction of regulatory frameworks, which can either bolster confidence or induce uncertainty among investors. For instance, China’s ban on cryptocurrency exchanges in 2017 led to a dramatic price drop, while the subsequent endorsement of Bitcoin by institutional investors in 2020 catalyzed an upward trajectory. Additionally, technological advancements, such as the implementation of the Lightning Network, have enhanced Bitcoin’s usability, further influencing its market value. Each of these events has contributed to the broader Bitcoin price history, showcasing the interplay between external factors and market sentiment in determining its trends.

Future Predictions: Where Is Bitcoin’s Price Headed?

What factors will shape Bitcoin’s price trajectory in the coming years? Analysts predict several key elements will influence Bitcoin’s price history as it evolves:

- Regulatory Developments: Changes in government policies can greatly impact market confidence.

- Institutional Adoption: Increased participation from institutional investors may stabilize prices and enhance legitimacy.

- Technological Innovations: Upgrades to the Bitcoin network could improve scalability and security, attracting more users.

- Market Sentiment: Public perception, often swayed by social media and major events, plays a vital role in price fluctuations.

Understanding these factors will be essential for individuals seeking to navigate the complex landscape of Bitcoin’s price history and make informed investment decisions.

Why Bitcoin Goes on Top

Bitcoin goes on top due to its unique combination of history, technology, and economic principles. Launched in 2009 by the anonymous Satoshi Nakamoto, it was the first cryptocurrency to solve the problem of decentralized digital money using blockchain and proof-of-work.

This early entry gave it a massive head start, allowing it to build the largest and most secure network of miners and nodes, making it highly resistant to attacks or manipulation. Bitcoin’s fixed supply of 21 million coins creates scarcity, driving long-term demand and positioning it as a hedge against inflation—often referred to as “digital gold.” It has the highest market capitalization, deep liquidity, and is the most widely recognized and adopted crypto asset, accepted by merchants, held by institutions, and even embraced by some governments. Its strong brand, transparency, and trustworthiness keep it firmly at the top of the crypto ecosystem.

Frequently Asked Questions

How Does Bitcoin’s Price Compare to Traditional Currencies?

Bitcoin’s price exhibits significant volatility compared to traditional currencies, often influenced by market sentiment and speculative trading. This unpredictability can attract investors seeking high returns, yet it poses risks not typically associated with conventional fiat currencies.

What Factors Affect Bitcoin’s Price Daily?

Several factors influence Bitcoin’s price daily, including market demand, regulatory news, technological developments, macroeconomic trends, and investor sentiment. Each element plays a vital role in shaping the cryptocurrency’s volatile market dynamics and overall valuation.

Can Bitcoin’s Price Be Predicted Accurately?

The accuracy of predicting Bitcoin’s price remains contentious. While historical trends and market data provide insights, volatility and external factors often hinder precise forecasting, emphasizing the need for cautious analysis in cryptocurrency investment decisions.

How Does Mining Influence Bitcoin’s Price?

Mining considerably influences Bitcoin’s price through supply dynamics; as miners validate transactions, the limited supply coupled with increasing demand often leads to price fluctuations. This interplay fosters a unique market environment that attracts various investors.

What Role Do Cryptocurrencies Play in Bitcoin’s Price Volatility?

Cryptocurrencies greatly contribute to Bitcoin’s price volatility through market speculation, regulatory changes, and technological advancements. These factors create a dynamic environment, influencing investor sentiment and causing rapid price fluctuations in Bitcoin’s price history.

Conclusion

To sum up, Bitcoin’s price history illustrates a complex interplay of market dynamics, regulatory influences, and economic events. Significant milestones, such as market adoption and technological advancements, have propelled its value, while regulatory changes and economic crises have introduced volatility. As investors seek to navigate this unpredictable landscape, understanding the historical context is essential for informed decision-making. Future price trends will likely continue to be shaped by these multifaceted factors, reinforcing the need for ongoing analysis and vigilance in cryptocurrency investment.