Market cap in cryptocurrency is an essential metric for investors seeking to optimize their portfolios. It is determined by multiplying the cryptocurrency’s current price by its circulating supply, reflecting its total market value. Higher market caps generally indicate greater stability and lower risk, while smaller caps may present higher volatility and potential rewards. Understanding these dynamics is fundamental for informed investment decisions, and further insights await those interested in exploring effective strategies and emerging trends.

Key Takeaways

- Understand market cap as a key indicator of a cryptocurrency’s total market value and stability.

- Use market cap to assess risk and align investment strategies with your risk tolerance.

- Diversify your portfolio by incorporating both large-cap for stability and small-cap for growth potential.

- Stay informed about market trends, historical data, and volatility metrics to enhance your investment decisions.

- Monitor regulatory developments and technological advancements, as they can significantly impact market cap dynamics and investor confidence.

Understanding Market Cap in Crypto: A Key Metric for Investors

Understanding market cap in crypto is essential for investors seeking to navigate the complexities of the digital currency landscape. Market capitalization, calculated by multiplying the current price of a cryptocurrency by its circulating supply, serves as a critical indicator of a coin’s total value within the market. This metric provides insights into the relative size and stability of different cryptocurrencies, allowing investors to assess risk and potential returns. For instance, large-cap cryptocurrencies tend to exhibit more price stability, while smaller-cap options may present higher volatility but greater growth potential. By analyzing cap in crypto, investors can make informed decisions, fostering a sense of community among those who prioritize data-driven strategies in their investment journeys.

The Importance of Market Cap in Crypto for Investment Decisions

Market cap in crypto serves as a critical indicator for investors, influencing their understanding of market dynamics and asset valuation. By evaluating market cap, investors can implement effective risk assessment strategies and enhance portfolio diversification. This metric not only reflects the size and stability of a cryptocurrency but also aids in making informed investment decisions.

Understanding Market Cap Dynamics

In the domain of cryptocurrency, market capitalization serves as a critical indicator of a digital asset’s overall value and potential for growth. Market cap is calculated by multiplying the current price of a cryptocurrency by its circulating supply, providing investors with insights into the asset’s market position relative to others. A higher market cap typically signifies greater stability and investor confidence, while lower market caps may indicate higher volatility and risk. Understanding these dynamics allows investors to make informed decisions, aligning their strategies with market trends. By evaluating market cap in crypto, investors can better gauge opportunities for investment, identify emerging assets, and navigate the complexities of the cryptocurrency landscape with greater assurance.

Risk Assessment Strategies

A thorough risk assessment strategy is essential for traversing the volatile landscape of cryptocurrency investment. Investors must consider cap in crypto as a critical factor in their evaluations. A higher market cap often indicates greater stability and lower risk, while lower market caps can signify higher volatility and potential for rapid price fluctuations. It is important to analyze historical performance data, market trends, and external factors impacting individual cryptocurrencies. Leveraging tools such as volatility metrics and liquidity assessments can further enhance risk management. By understanding the implications of market capitalization on investment decisions, investors can better align their strategies with their risk tolerance, ultimately fostering a sense of community and shared purpose within the cryptocurrency ecosystem.

Portfolio Diversification Benefits

While many investors recognize the importance of diversifying their portfolios, understanding how market cap in crypto influences this strategy is essential. Market capitalization serves as a vital indicator of a cryptocurrency’s stability and growth potential. By incorporating assets across various market cap tiers—large, mid, and small—investors can balance risk and reward. Large-cap cryptocurrencies tend to offer more stability, while small-cap coins may provide significant upside potential. This diversification allows investors to mitigate losses during market downturns while capturing growth opportunities. Additionally, analyzing market cap trends aids in identifying emerging projects that align with investors’ risk tolerance and investment goals, fostering a sense of community among like-minded individuals committed to informed decision-making in the dynamic crypto landscape.

How to Calculate Market Cap in Crypto: A Step-by-Step Guide

Calculating market cap in crypto is essential for investors seeking to understand the relative value of various cryptocurrencies. The formula to determine market cap is straightforward: multiply the current price of a cryptocurrency by its circulating supply. For instance, if a coin is priced at $50 and there are 1 million coins in circulation, the market cap would be $50 million. This metric provides insight into the cryptocurrency’s size and investment potential. Investors should also consider the market cap in relation to other coins to gauge competition and growth opportunities.

Understanding this calculation helps investors make informed decisions, contributing to a more robust investment strategy within the dynamic crypto landscape.

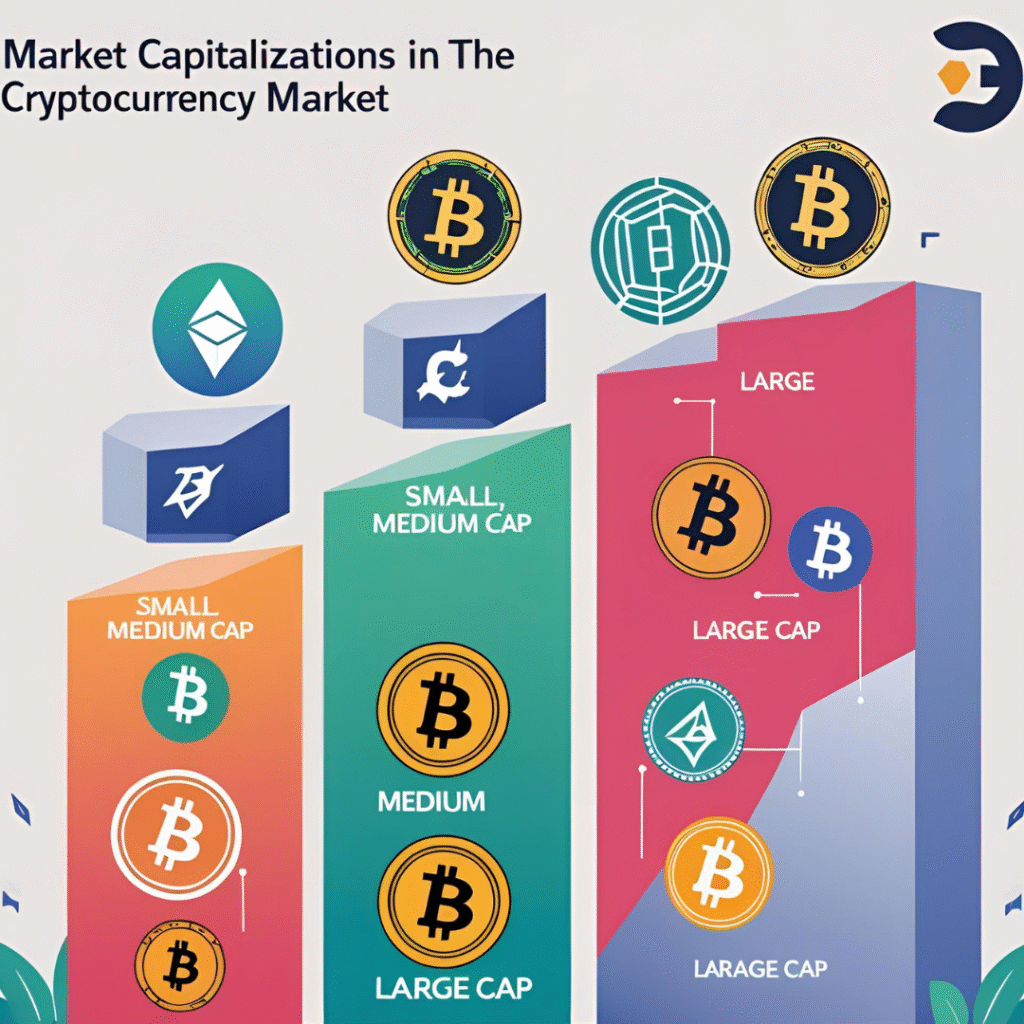

Different Types of Market Caps in Crypto: Small, Medium, and Large

Market capitalization, often referred to as market cap, serves as a critical indicator in the cryptocurrency ecosystem, categorizing assets into small, medium, and large market caps. Small-cap cryptocurrencies typically have a market cap under $1 billion and can present high volatility and risk but also significant growth potential. Medium-cap assets, ranging from $1 billion to $10 billion, often offer a balance between risk and growth, appealing to investors seeking moderate returns. Large-cap cryptocurrencies, with market caps exceeding $10 billion, are generally viewed as more stable investments, often representing established projects with greater liquidity.

Understanding these categories helps investors align their strategies with their risk tolerance and investment goals, fostering a sense of community among informed participants in the crypto market.

Analyzing Market Cap in Crypto: Strategies for Smart Investing

Understanding how to effectively analyze market cap in crypto can greatly enhance investment strategies. Investors should consider the market capitalization of cryptocurrencies as a primary indicator of their stability and potential growth. A thorough analysis involves examining not just the total market cap, but also the circulating supply and trading volume. Diversifying investments across different market cap categories—small, medium, and large—can mitigate risk while maximizing opportunities. Additionally, tracking market cap trends over time can reveal valuable insights into market sentiment and emerging projects. By employing these strategies, investors can make informed decisions that align with their financial goals, fostering a sense of community among like-minded individuals seeking to navigate the complex landscape of crypto investment.

Risks and Rewards: Navigating Market Cap in Crypto

Investors face a complex landscape in the domain of cryptocurrencies, where the interplay of risks and rewards is heavily influenced by market cap in crypto. Understanding this relationship is essential for making informed decisions. Market cap can indicate a cryptocurrency’s stability and growth potential, but it also comes with inherent risks.

Key considerations include:

- Volatility: Larger market caps may stabilize prices, yet even established coins can experience significant fluctuations.

- Liquidity: High market cap generally guarantees better liquidity, but emerging coins may face challenges in this area.

- Innovation: Cryptocurrencies with lower market caps may offer high reward potential, though they often carry higher risk.

Navigating these factors allows investors to balance their portfolios effectively within the crypto space.

Future Trends: Market Cap in Crypto and What Investors Should Watch For

As the cryptocurrency landscape continues to evolve, future trends related to market cap in crypto become increasingly important for stakeholders. Analysts are closely monitoring the shift towards decentralized finance (DeFi) and non-fungible tokens (NFTs), which may disrupt traditional market cap metrics. A greater emphasis on market capitalization dominance could emerge, as investors seek to identify leading currencies amid market volatility. In addition, regulatory developments are likely to impact market dynamics, influencing investor confidence and asset valuations. Moreover, advancements in blockchain technology may lead to increased adoption, subsequently affecting market cap trends. Investors should watch for these factors, as understanding the evolving cap in the crypto market will be vital for making informed investment decisions in the coming years.

Frequently Asked Questions

How Often Does the Market Cap of Cryptocurrencies Change?

The market cap of cryptocurrencies fluctuates frequently, often changing multiple times within a single day. Factors such as trading volume, investor sentiment, and overall market trends contribute to these dynamic shifts in valuation.

Can Market Cap Predict Cryptocurrency Price Movements?

Market cap can provide insights into potential price movements, as higher market capitalization often indicates greater stability and investor confidence. However, it is not a definitive predictor, as market dynamics are influenced by various external factors.

What Factors Influence Market Cap Fluctuations in Crypto?

Market cap fluctuations in crypto are influenced by factors such as investor sentiment, regulatory developments, technological advancements, market liquidity, and macroeconomic trends. Understanding these elements helps stakeholders navigate the volatile landscape of cryptocurrency investments effectively.

Are Stablecoins Included in Market Cap Calculations?

Stablecoins are generally included in market cap calculations, as they represent a significant portion of the cryptocurrency ecosystem. However, their impact on overall market dynamics differs from that of more volatile cryptocurrencies, affecting investor sentiment.

How Does Market Cap Affect Liquidity in Crypto Markets?

Market cap notably influences liquidity in crypto markets. Higher market caps generally indicate greater investor confidence and trading volume, allowing for easier buying and selling, which enhances overall market efficiency and price stability for participants.

Conclusion

In summary, understanding market capitalization in cryptocurrency is vital for investors aiming to make informed decisions. By analyzing market cap, investors can effectively assess the relative size, growth potential, and associated risks of various digital currencies. The categorization of cryptocurrencies into small, medium, and large market caps provides further insight into investment strategies. As the crypto landscape evolves, keeping abreast of market cap trends will be important for optimizing investment portfolios and maneuvering this dynamic financial environment.