Bitcoin vs. Ethereum are two leading cryptocurrencies, each with distinct roles. Bitcoin serves primarily as a digital currency and store of value, often referred to as “digital gold.” In contrast, Ethereum enables smart contracts and decentralized applications (dApps), driving innovation across sectors. Bitcoin maintains a capped supply of 21 million coins, while Ethereum has no fixed limit. Their differing functionalities and market performances prompt investors to evaluate which asset best suits their goals, with more insights to explore.

Key Takeaways

- Bitcoin is often referred to as “digital gold,” focusing on security and serving as a store of value.

- Ethereum enables smart contracts and decentralized applications, positioning it as a leader in innovation.

- Bitcoin has a capped supply of 21 million coins, while Ethereum has no fixed supply, affecting their value dynamics.

- Bitcoin consistently leads in market capitalization, while Ethereum shows greater price fluctuations and long-term growth potential.

- Future trends suggest Bitcoin’s scarcity may enhance its value, while Ethereum’s versatility attracts a growing user base in various sectors.

Overview of Bitcoin and Ethereum

Although Bitcoin and Ethereum are often discussed in tandem due to their prominence in the cryptocurrency market, they serve distinct purposes and operate on differing underlying technologies. Bitcoin, launched in 2009, primarily functions as a decentralized digital currency designed to facilitate peer-to-peer transactions without the need for intermediaries. Its blockchain technology is designed for security and transparency, facilitating a limited supply of 21 million coins.

In contrast, Ethereum, introduced in 2015, is a platform that enables the creation of decentralized applications (dApps) through smart contracts. Its blockchain supports an expansive ecosystem, allowing developers to build and deploy applications across various industries. Together, Bitcoin and Ethereum represent two pivotal innovations in the cryptocurrency landscape, each attracting a diverse community of users and investors.

Key Differences Between Bitcoin and Ethereum

Bitcoin and Ethereum, while both leading cryptocurrencies, exhibit several key differences that define their functionality and use cases. Primarily, Bitcoin serves as a digital currency, designed to facilitate peer-to-peer transactions and store value. In contrast, Ethereum functions as a decentralized platform that enables smart contracts and decentralized applications (dApps), expanding its utility beyond mere transactions. Additionally, Bitcoin operates on a proof-of-work consensus mechanism, while Ethereum is evolving to proof-of-stake, enhancing energy efficiency and scalability. The total supply of Bitcoin is capped at 21 million coins, creating scarcity, whereas Ethereum has no fixed supply, allowing for greater flexibility in its economic model. These distinctions are fundamental in understanding the ongoing debate of Bitcoin Vs. Ethereum.

Use Cases and Applications of Bitcoin

In the context of Bitcoin Vs Ethereum, Bitcoin is often referred to as “digital gold,” serving as a store of value for investors seeking a hedge against inflation. Additionally, its design facilitates peer-to-peer transactions, allowing users to transfer value directly without intermediaries. These characteristics underscore Bitcoin’s unique role in the cryptocurrency landscape.

Digital Gold Concept

The concept of digital gold has gained significant traction in the cryptocurrency landscape, with Bitcoin often being hailed as a prime example. This characterization stems from Bitcoin’s limited supply, capped at 21 million coins, which mirrors gold’s scarcity and serves as a hedge against inflation. Investors increasingly view Bitcoin as a store of value, akin to traditional gold, especially during economic uncertainty. In addition, Bitcoin’s decentralized nature enhances its appeal, allowing for increased security and independence from government manipulation. The growing acceptance of Bitcoin in various financial institutions further solidifies its position as digital gold. As discussions around Bitcoin vs. Ethereum continue, the digital gold concept remains a pivotal factor influencing investor sentiment and market dynamics.

Peer-to-Peer Transactions

While many cryptocurrencies offer various functionalities, the peer-to-peer transaction capabilities of Bitcoin are particularly remarkable. This system allows users to transfer value directly to one another without intermediaries, facilitating fast and cost-effective transactions globally. Bitcoin’s decentralized nature guarantees that these transactions are secure and transparent, as they are recorded on a public blockchain. This feature appeals to individuals seeking autonomy over their financial interactions, fostering a sense of belonging within a community that values privacy and independence. Additionally, Bitcoin’s scalability continues to evolve, enhancing its application in everyday transactions. As the cryptocurrency landscape develops, the ongoing relevance of Bitcoin in peer-to-peer transactions remains a significant aspect of the ongoing Bitcoin vs. Ethereum discourse.

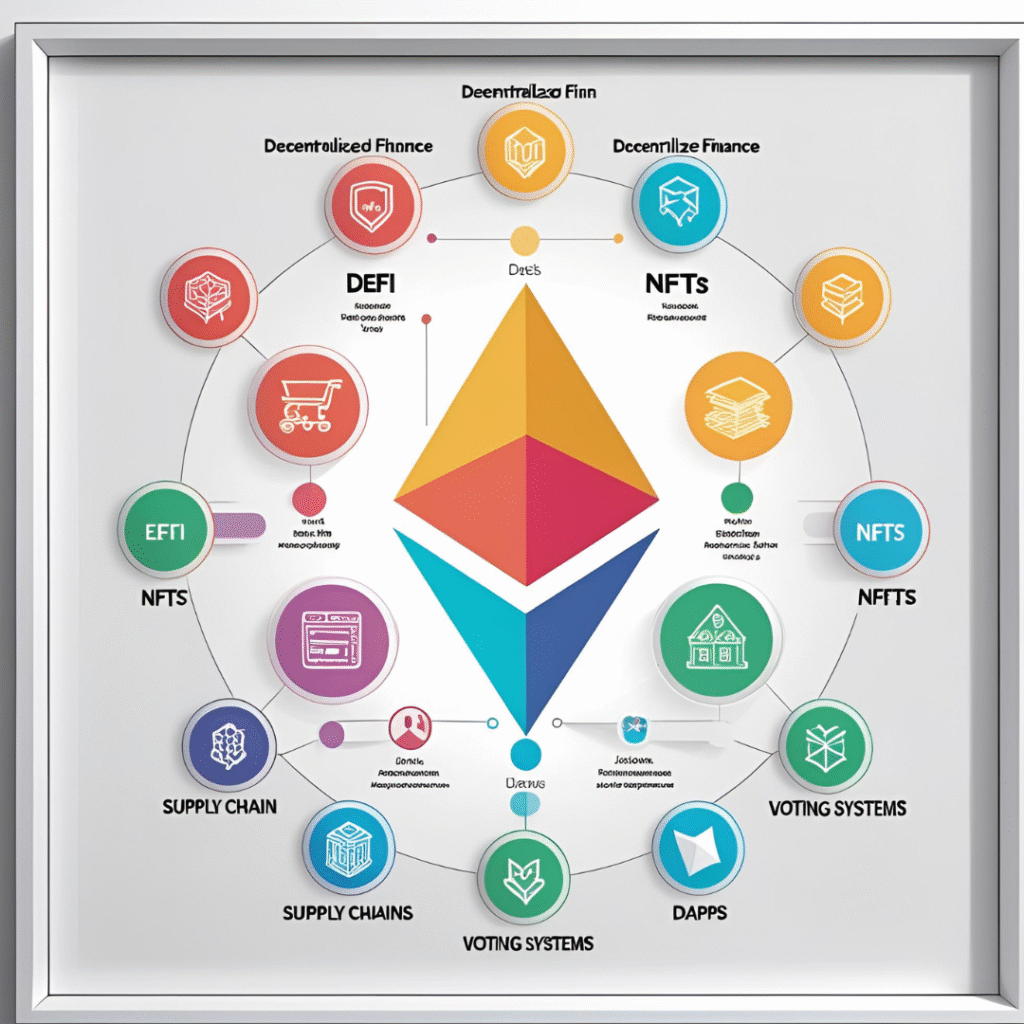

Use Cases and Applications of Ethereum

Ethereum’s architecture supports the implementation of smart contracts, which automate transactions and enforce agreements without intermediaries. Additionally, it serves as a platform for decentralized applications (DApps), enabling developers to create and deploy applications that operate on blockchain technology. These functionalities distinguish Ethereum in the cryptocurrency landscape, particularly when compared to Bitcoin.

Smart Contracts Functionality

Smart contracts represent a revolutionary advancement in blockchain technology, particularly within the Ethereum ecosystem. These self-executing contracts facilitate transactions without intermediaries, enhancing efficiency and reducing costs. By utilizing predefined protocols, smart contracts automatically enforce and execute agreements, mitigating the risk of fraud or error. Various use cases have emerged, such as decentralized finance (DeFi), where users can lend or borrow assets securely, and supply chain management, ensuring transparency and traceability. Additionally, they enable tokenization of assets, allowing fractional ownership and democratizing investment opportunities. The versatility of smart contracts highlights Ethereum’s potential to disrupt traditional industries, positioning it as a formidable player in the ongoing Bitcoin vs. Ethereum debate. Their functionality is a key aspect of Ethereum’s value proposition.

Decentralized Applications (DApps)

Decentralized applications (DApps) leverage the robust capabilities of blockchain technology to deliver innovative solutions across various sectors. Ethereum, as a leading platform for DApps, has enabled the creation of diverse applications that exemplify its potential. Key use cases include:

- Finance: DApps like decentralized exchanges (DEXs) facilitate peer-to-peer trading without intermediaries, enhancing transaction efficiency.

- Gaming: Platforms such as CryptoKitties showcase how DApps can create digital collectibles, merging entertainment with blockchain technology.

- Supply Chain Management: DApps enable transparent tracking of products, improving trust and reducing fraud in logistics.

These applications underscore Ethereum’s versatility, positioning it as a formidable contender in the ongoing Bitcoin vs. Ethereum debate, while fostering a sense of community and innovation among users.

Market Performance: Bitcoin Vs. Ethereum

The cryptocurrency market is often characterized by the stark performance differences between Bitcoin and Ethereum, two of the most prominent digital assets. Bitcoin, launched in 2009, has consistently maintained its position as the market leader, often reflecting a more stable price trajectory despite volatility. As of October 2023, Bitcoin’s market capitalization remains considerably higher than Ethereum’s, underscoring its status as a store of value. In contrast, Ethereum, introduced in 2015, has experienced rapid growth and adoption, particularly due to its smart contract functionality. While Ethereum’s price can exhibit greater fluctuations, it has shown impressive returns over time. Investors often weigh these performance metrics carefully, with Bitcoin representing security and Ethereum embodying innovation, contributing to their unique positions in the market.

The Future Outlook for Bitcoin and Ethereum

As market dynamics evolve, the future outlook for Bitcoin and Ethereum presents a fascinating study in contrasts. Analysts project varying trajectories for these two leading cryptocurrencies, influenced by their unique characteristics and market roles.

- Bitcoin’s Role as Digital Gold: Bitcoin may solidify its position as a hedge against inflation, appealing to institutional investors seeking stability.

- Ethereum’s Technological Advancements: With its shift to proof-of-stake and expanding functionalities, Ethereum could enhance its utility, attracting decentralized finance (DeFi) applications and developers.

- Regulatory Impact: Both cryptocurrencies face potential regulatory scrutiny, which could shape their adoption and market behavior, emphasizing the need for adaptive strategies.

Final Thoughts on Bitcoin Vs. Ethereum

While both Bitcoin and Ethereum have established themselves as leaders in the cryptocurrency space, their distinct characteristics and market roles suggest divergent paths moving forward. Bitcoin, often referred to as digital gold, continues to serve primarily as a store of value and medium of exchange, appealing to investors seeking stability and security. In contrast, Ethereum’s robust platform enables decentralized applications and smart contracts, positioning it as a leader in innovation and utility within the blockchain ecosystem. As market trends evolve, Bitcoin’s scarcity and established network may maintain its dominance, while Ethereum’s adaptability could attract a growing user base. Ultimately, the future landscape of cryptocurrency will likely be shaped by the unique strengths of both Bitcoin and Ethereum, fostering a diverse and inclusive digital economy.

Frequently Asked Questions

What Are the Transaction Fees for Bitcoin vs. Ethereum?

Transaction fees for Bitcoin typically range from $1 to $3, depending on network congestion, while Ethereum fees can vary considerably, often exceeding $5 during peak times. Both cryptocurrencies exhibit fluctuating costs influenced by demand and scalability.

How Secure Are Bitcoin and Ethereum Networks?

The security of Bitcoin and Ethereum networks is robust, utilizing advanced cryptographic techniques and decentralized consensus mechanisms. Bitcoin’s proof-of-work model contrasts with Ethereum’s evolving proof-of-stake approach, each providing unique strengths in safeguarding their respective ecosystems.

Can Bitcoin and Ethereum Be Mined?

Both Bitcoin and Ethereum can be mined, but they utilize different algorithms. Bitcoin relies on the Proof of Work model, while Ethereum is shifting to Proof of Stake, impacting their mining approaches and energy consumption.

What Wallets Are Best for Bitcoin vs. Ethereum?

When considering wallets for cryptocurrency, both Bitcoin and Ethereum users benefit from options such as hardware wallets for security, software wallets for convenience, and custodial wallets for ease of access, catering to diverse user preferences and needs.

How Do Regulations Affect Bitcoin and Ethereum?

Regulations greatly influence the cryptocurrency market, impacting operational frameworks, compliance requirements, and investor confidence. Both Bitcoin and Ethereum face evolving regulatory landscapes, which can affect their adoption, market stability, and long-term growth potential.

Conclusion

To sum up, the debate between Bitcoin and Ethereum reflects distinct technological philosophies and market roles. Bitcoin serves as a secure store of value, while Ethereum’s smart contract capabilities position it as a transformative platform for decentralized applications. Market performance indicates that both assets hold significant potential, albeit with varying risk profiles. As the cryptocurrency landscape continues to evolve, the future of both Bitcoin and Ethereum will likely hinge on their adaptability to emerging trends and investor sentiment.